The level of uncertainty surrounding the US presidential election may have narrowed in recent weeks,

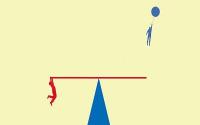

but there are still many investors who, given the upset of the 2016 election, have preferred to sit out the campaign. While this approach may provide a degree of comfort, history tells us that, on average, US equities rise in the month after the election, although the strength of that rise has varied.

In this week’s Strategy Espresso, we look at some of the US equity exposures investors could consider as we move past the presidential election, including across the market cap spectrum and in sectors.

Webcast Invitation - US Elections: What Now?

As the election day approaches, many investors fear the outcome will be undecided and the winner won’t be known on 4 November. Among the different political scenarios and their economic consequences, which one will happen?

In November 2016, just after Trump’s election, the dispersion between the best and worst performing S&P sectors was 19% (between Financials and Utilities). 1 Since the start of 2020, this difference has already been 74% (Technology and Energy). 2 Will the relative performance between sectors change? What impact will the election have on sector investments this time around?

Join Elliot Hentov, Ph.D, Head of Policy Research at State Street Global Advisors and Rebecca Chesworth, Senior Equity ETF Strategist at SPDR ETFs, to analyse the results of the election and take stock of the situation.