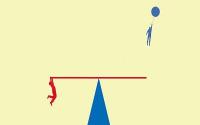

Whilst economic and earnings growth forecasts remain attractive, investors are more nervous, startled by the prospect of a trade war and the fall in high-profile technology shares. Investing in sectors allows investors to potentially capture the returns of the best performing parts of the market and avoid the rest.

Download: Sector Dashboard April 2018

Global equity markets continued to experience downward pressure in March as the MSCI World Index fell 2.48%. The story in Europe was a bit different in March as flows were more mixed. The Health Care sector led in terms of new flow, but flows into Technology were also positive in Europe.

Download: Sector Snapshot April 2018

With uncertainty in the air, a sector approach can provide investors with a way to target their exposures.

By implementing a sector strategy, investors can potentially capture the dispersion of betas that results when certain markets enjoy stronger tailwinds than others.