Despite the recent correction, the significant rise in equity markets over the past year has made the outlook more challenging for returns. Sector investments offer a potential salve to nervous markets in terms of selective market exposure. Market dynamics have stayed fairly consistent in the past month; as such, most of our sector picks are unchanged.

What a start to the new year. Sector investing continued its run in January, demonstrated by the significant inflows into equity ETFs. Technology and Financials both experienced large inflows, extending their popularity over the last 12 months. Whilst Technology suffered from sector rotation towards the end of last year, further earnings momentum has renewed investor confidence. Read more.

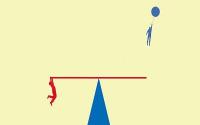

Flows trended into cyclical sectors and out of defensives. This included some notable trades into the Industrial US-domiciled ETF space, attracted by talk of infrastructure spending by the current US administration. We saw a correction and volatility spike at the start of February that caused net outflows, but they were small compared to last month’s inflows. Download: Sector Dashboard February 2018