As the push for rapid decarbonization intensifies, investors are increasingly turning to the European Union Climate-Transition (CTB) and Paris-aligned benchmarks (PAB) to guide portfolio decarbonization. Due to varying carbon footprints across sectors, decarbonization rates differ significantly. This article examines how decarbonization trajectories and climate benchmark alignment affects portfolio diversification and risk.

Executive summary

- The EU Climate-Transition (CTB) and Paris-Aligned Benchmarks (PAB) provide measurable pathways for investors to achieve net-zero targets within their equity portfolio.

- Implementation guidance: the benchmark guidance allows flexibility in rebalancing and reweighting but requires maintaining exposure to high-impact sectors.

- Simulation results: Maintaining high-impact sector exposure leads to overallocation of firms with the lowest footprints, making sector classification crucial.

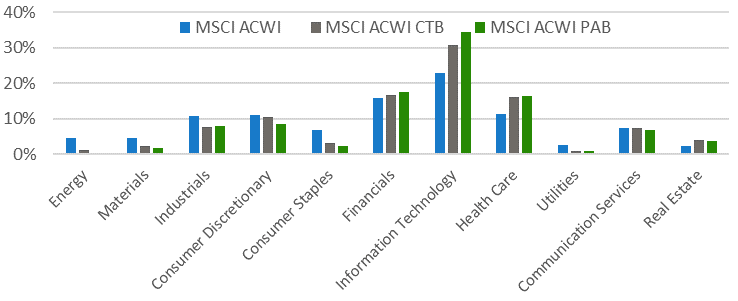

- Long-term: CTB and PAB-aligned portfolios tend to concentrate on sector (see figure 1 below), country and issuer-level, with a clear tilt towards growth stocks.

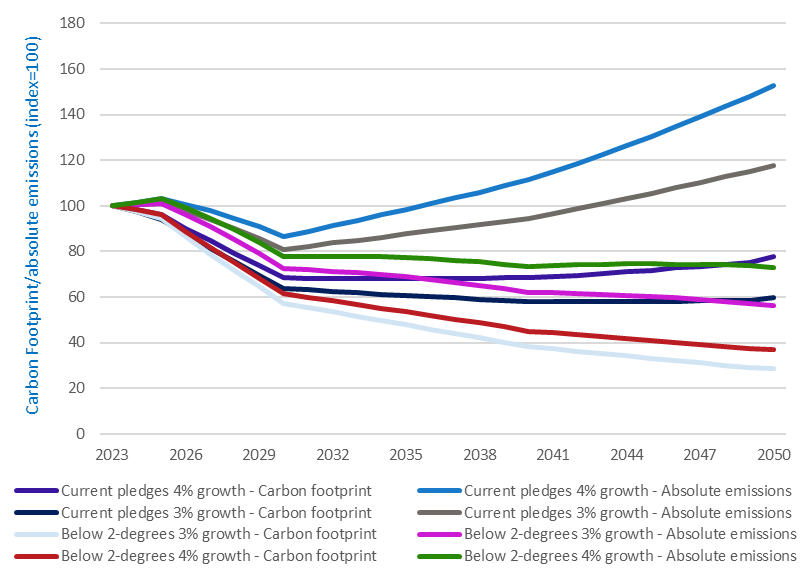

- Emission pathways: Demand growth in certain high-impact sectors outpaces per-unit footprint reduction, increasing absolute emissions under various scenarios (see figure 2 below).

Figure 1: Sector distribution in 2035 of CTB & PAB

Source: Aegon Asset Management, MSCI (as of 2024). Simulations consider the period 2018-2035, from 2024 onwards weights are simulated.

Figure 2: Carbon reduction pathways for aviation sector based on TPI data

Source: Aegon Asset Management, Transition Pathway Initiative (2024). Simulations for the period 2024-2035.

Click here for our full paper on sector-based decarbonization and the simulation of EU climate benchmarks.

This material is provided by Aegon Asset Management (Aegon AM) as general information and is intended exclusively for institutional, qualified, and wholesale investors, as well as professional clients (as defined by local laws and regulation) and other Aegon AM stakeholders.

Past performance is not a guide to future performance. All investments contain risk and may lose value. Investments in high yield bonds may be subject to greater volatility than fixed income alternatives, including loss of principal and interest, as a result of the higher likelihood of default. The value of these securities may also decline when interest rates increase. The amount of income received by a portfolio will go up or down depending on day-to-day variations in short-term interest rates, and when interest rates are very low the portfolio’s expenses could absorb all or a significant portion of the portfolio’s income. If interest rates increase, the portfolio’s yield may not increase proportionately.

There is no guarantee these investment or portfolio strategies will work under all market conditions or are suitable for all investors and each investor should evaluate their ability to invest over the long-term, especially during periods of increased market volatility.

This material contains “forward-looking statements” which are based on Aegon AM’s beliefs, as well as on a number of assumptions concerning future events, based on information currently available. These statements involve certain risks, uncertainties and assumptions which are difficult to predict. Consequently, such statements cannot be guarantees of future performance, and actual outcomes and returns may differ materially from statements set forth herein.

The information contained in this material does not take into account any investor’s investment objectives, particular needs, or financial situation. It should not be considered a comprehensive statement on any matter and should not be relied upon as such. Nothing in this material constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to any particular investor. Reliance upon information in this material is at the sole discretion of the recipient. Investors should consult their investment professional prior to making an investment decision.

Aegon Asset Management entities deliver services to, and share resources with, one another pursuant to applicable law as well as both global and local, policies, monitoring, and supervision. Personnel employed by a foreign Aegon Asset Management entity engaged in activity for, or through, a local Aegon Asset Management entity are subject to that local entity’s applicable requirements and oversight. This may include the use of delegation arrangements and/or a participating affiliate arrangement (as this term is used by the U.S. Securities and Exchange Commission (SEC).

Aegon AM is under no obligation, expressed or implied, to update the information contained herein. Neither Aegon AM nor any of its affiliated entities are undertaking to provide impartial investment advice or give advice in a fiduciary capacity for purposes of any applicable US federal or state law or regulation. By receiving this communication, you agree with the intended purpose described above. The following Aegon affiliates are collectively referred to herein as Aegon Asset Management: Aegon USA Investment Management, LLC (Aegon AM US), Aegon USA Realty Advisors, LLC (Aegon RA), Aegon Asset Management UK plc (Aegon AM UK), and Aegon Investment Management B.V. (Aegon AM NL). Each of these Aegon Asset Management entities is a wholly owned subsidiary of Aegon Ltd.

Aegon Asset Management generally provides products and services to qualified institutions, financial intermediaries, and institutional investors. This material shall not be considered an offer to any investor in any country or jurisdiction where unlawful or unauthorized.

Aegon AM UK is authorized and regulated by the Financial Conduct Authority (FRN: 144267) and is additionally a registered investment adviser with the United States (US) Securities and Exchange Commission (SEC). Aegon AM US and Aegon RA are both US SEC registered investment advisers. Aegon AM NL is registered with the Netherlands Authority for the Financial Markets as a licensed fund management company and on the basis of its fund management license is also authorized to provide individual portfolio management and advisory services in certain jurisdictions. Aegon AM NL has also entered into a participating affiliate arrangement with Aegon AM US. ©2024 Aegon Asset Management or its affiliates. All rights reserved.

AdTrax code: 7250132.1. | Expiration date: 31/October/2025.